To continually provide meaningful and evaluation-driven programming, Words Alive commenced the seven-month Dialogues in Action (DIA) project to analyze the impact of our Words Alive Westreich Scholarship (WAWS) program using a blended qualitative and quantitative evaluation model. Through this process, we had an opportunity to view our program through the lens of the scholarship recipients, past and present, and their mentors to determine opportunities to enhance our program delivery.

The aim of our evaluation was to ascertain the type of impact our program has on the Words Alive Westreich Scholarship recipients. We interviewed nine scholars who received various amounts of money through their participation in the program and six mentors who worked with students locally and remotely across several program years. In addition, we designed a questionnaire and sent it to the entire WAWS population (current and previous scholars) to collect data geared toward quantitative measurements.

Throughout this process, we identified eight findings and then brainstormed on ways we could update and improve the program based on these findings. Here is the first finding!

An image of the 2017-2018 Words Alive Westreich Scholarship students at their financial literacy workshop at Finance Park.

More Than Money: Learning from and Limitations of financial awards

One might assume that the most impactful element of a scholarship program would be the money itself. However, our research found that the money awarded through the scholarship was not enough to negate the broader constraints of scholars’ financial circumstances nor to ensure a sense of financial security. That being said, a much-welcomed finding is that, as a group, scholars are thinking about and using money differently than they did before the program.

The scholarship program has several features intended to help students develop positive financial habits and feel more financially secure. Unlike many traditional scholarship programs, students can spend their awarded funds on living expenses such as rent, food, public transportation and child care. Money is disbursed monthly into personal checking accounts for greater access to cover these kinds of off-campus expenses and is often a student’s first time establishing a relationship with a bank. Additionally, students attend a financial literacy course led by experts in the field and are encouraged to work with their mentor on budgeting practices throughout the year.

Interviews with scholars who attended the workshop and/or addressed budgeting with their mentor described a better understanding of spending behaviors and different decision making about how to use their money.

About understanding their spending behavior, scholars said:

“[The financial workshop] made me realize how much I was wasting and how much I accumulate each month by going to restaurants instead of eating at home.” – Scholar, age 22

“I've been using a template that my mentor shared with me. I ask myself, ‘Do I really need this? Do I want to waste my money on this? Have I bought the right things first?’ I'm more aware of what I buy...For example, do I want to go to Jack in the Box and feed myself for an hour or go to the grocery store and feed myself for a week.” – Scholar, age 26

A graphic featuring the above quote over a background of a few dollars and coins spread out over a counter.

About making money decisions differently, many scholars reported saving money for the first time in their lives, while others described strategizing their spending in other ways:

“I’m spending more of my money on school supplies and using free school resources for food. I’m saving scholarships for further down the line. I’m using that money for other materials, like in 1-2 years when I know I’ll have like a $5,000 tuition. So, I’m planning for that...I’m stretching my budgets to cover everything I need. I’ll spend 3 days researching something I need to buy to find the best price. I think these changes are feeding my motivation and keeping it alive. “– Scholar, age 20

“When I first got the scholarship, I was going through a tough time. I had just been kicked out of my living situation and I was living off the scholarship money. So, I learned how to budget money for necessities like food. I had my young daughter, so I had to think about her. I didn’t really have help, so I had to figure it out on my own and I was very young. This taught me how to save money and not spend on things you don’t need. And the scholarship money was limited so I learned how to extend it out.” – Scholar, age 18

Survey responses reflected a similar sentiment, in which after participating in the program, 85% scholars reported that they often or always use budgeting skills and tools to manage their financial situation than reported doing so before participating in the program.

A graph titled “% of scholars who reported often or always using budgeting skills and tools.” It shows that 85% use budgeting skills after participation in the program and 15% use them before the program.

It wasn’t easy though, and in their eyes, consistency and discipline with budgeting remains a challenge:

“I go on and off with the financial habits. I try to tell myself, it’s okay just keep it in your head. I have done better budgeting in the past, but then I have an emotional breakdown and that makes all the habits go away. I want to get back to it...I just need more practice with budgeting.” – Scholar, age 22

“My [money] management fluctuates. I set up a savings account at a different bank not tied to the app on my phone where I can transfer money between accounts easily, and I didn't get the card. That way I have to make a special trip to the bank to take the money out, which I know I wouldn't want to do. I'll save up a lot, like $500 until recently, but then I'll dip into it for some expense and have to build it back up. Now I have $260+ in that account and I know I have to get back on track and not touch it.” – Scholar, age 26

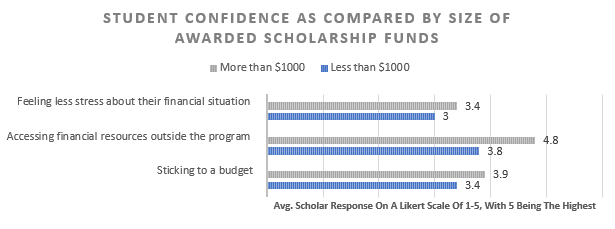

We believe a contributing factor to success with budding budgeting skills may be the amount of money awarded to scholars. All scholars participating in the program have been impacted by extraordinary life circumstances and the financial hardship connected to those circumstances, and there was consensus among interviewed scholars that the amount of their financial award was not significant enough to cause lasting financial change or relief in the larger context of their lives. However, seen in the chart below, students who received larger financial awards reported feeling less stressed about their financial situation, as well as sticking to their personal budget and accessing financial resources outside their scholarship more often.

A graph titled “Student confidence as compared by size of awarded scholarship funds.” The graph compares responses to statements such as “feeling less stress about their financial situation” based on how much money they receive.

Significance

A central goal of the WAWS program is to provide funding to support a scholar’s academic trajectory. That the financial component is not restricted to certain kinds of expenses makes the scholarship both unique and a powerful tool to address the “real life” financial obstacles that keep scholars from focusing on their education. As it stands, scholarship awards are not enough to remove those obstacles completely. An intended impact for this program is that scholars work toward a level of financial sustainability by building positive financial habits. As one mentor put it, “any new financial habits are a big deal” and while not perfect in execution, new understanding and practices are in fact taking hold and endowing scholars with a new skillset for managing their challenging financial situations to leverage the resources they have.

One scholar summarized this reality beautifully:

“I have more common sense, better decision-making skills and am wiser. Financial burden takes a lot out of you, [but] I don’t feel as dragged down by it.” – Scholar, age 20

Learn more about the Words Alive Westreich Scholarship program here!